How You Can Raise Your Credit Score

Whether you have a good credit score or a not so good score, you may be interested in how you can raise your credit score.

Your credit score affects the interest rate you’re offered when applying for a mortgage, credit cards, applying for an apartment, and it can even affect jobs that you apply for.

Disclosure: There are some affiliate links below and I may receive commissions for purchases made through links in this post at no additional costs to you.

Typically, the higher your credit score, also known as your FICO score, the lower the interest rate you’re offered.

That means that with a poor credit score and a higher interest rate, you can end up paying tens of thousands of dollars more over the life of a loan.

The FICO score range goes from a high of 850 to the lowest of 300.

Most folk fall somewhere in between that range. Get a copy of your FICO score here.

I attended a recent seminar on raising your credit score, and below are some of the takeaways I made note of to share with you, along with some of the ways I’ve learned over the years.

1. Start by getting a copy of your free annual credit report

The 3 main credit bureaus are Equifax, Experian, and TransUnion.

Each credit agency offers you a free copy of your credit report every 12 months.

Get your free annual copy at annual credit report from each of the 3 credit bureaus so that you know where you stand.

I like to get a copy of all 3 of mine at one time so that I can view comparisons on each report.

Others like to stagger their request and get a different free report every 4 months.

I also like to order my reports at least twice a year, even though I have to pay for the second copies.

2. Look for and fix any discrepancies on your credit reports.

There are more credit repair company’s than you can count that will offer to fix your credit discrepancies for a price.

There’s no reason why you can’t respond to any inaccurate information yourself and save your precious dollars.

Find more detailed information here on nerdwallet.com on how to dispute and fix errors on your credit report.

3. Watch your amount of credit used.

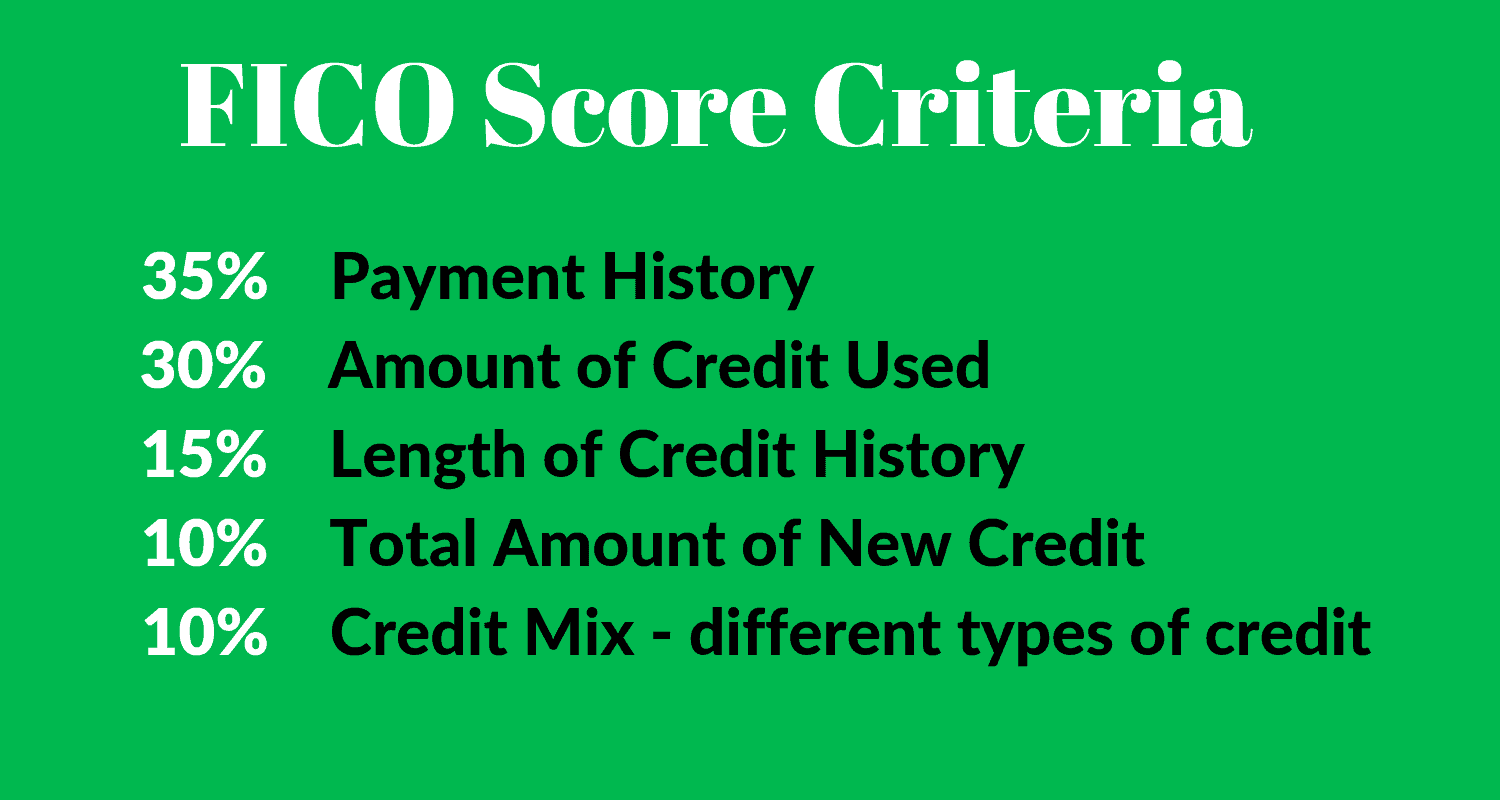

Your amount of revolving credit is one of the main factors in determining your credit score and accounts for 30% of your FICO score.

A quick way to boost your credit score is to pay down your revolving credit owed to below 30%.

As an example, if you have a credit card with a line of credit that’s $1,000, aim to keep the amount owed below $300 ($1,000 x 30%), and preferably, pay them in full each month.

4. Establish credit.

If you don’t have any credit, start by establishing credit.

Consider opening a new credit card, or a secured card if you don’t qualify for an unsecured card.

Please look at #5 below and pay those charges off each month.

5. Pay your bills on time.

Set up calendar reminders to pay your bills on time – or automate them.

On my road to credit score recovery, I put as many bills on auto-pilot as possible, totally eliminating late fees and hits to my credit score.

6. Don’t remove old debt from your credit report.

Bills that have favorable payment history over a long period of time are a plus factor for your credit score, so leave them on for as long as possible.

Your payment history accounts for 35% of your FICO score.

7. Search for loans in a certain time frame.

If shopping for a loan, such as a car or home loan from different lenders, try to fill out all of the applications in a certain time period so they will all gather as one hit to your credit report, vs multiple hits, which can lower your credit score.

NOTE: Checking your own credit report will not cause your credit score to go down.

After 7 years, derogatory accounts fall off of your credit report.

Seven years can seem like an eternity, so do everything in your power to keep a clean bill-paying history.

“Credit is a game that you have to learn to play. It’s never too late to restart your credit life.”

Here’s the breakdown on the criteria the credit bureau’s use in determining your credit score:

A higher credit score is your secret weapon to saving money because you’ll now have more leverage and bargaining power for life occurrences like vehicle purchases and interest rates.

What methods have you used to raise your credit score?

Share it with us in the comment space below.

Related Posts

10 Ways to Make Your Money Grow

8 Amazing Ways to Save More Money