I Quit My Job and Retired Early!

After asking myself ‘When is enough – enough?’, I realized it was time to quit my job and retire early.

Disclosure: There are some affiliate links below and I may receive commissions for purchases made through links in this post at no additional cost to you.

Are you already retired? Did you take early retirement?

Are you going to work every day, sitting within the four walls known as your office, feeling caged and it’s literally driving you insane?

Then, you probably know how I felt.

Ready to Quit My Job.

After working for years with the federal government, I decided to call it quits. Yep, I retired from my corporate job.

You Know When It’s Time to Go

It did not matter that I was well past the F.I.R.E. (Financial Independence Retire Early) age, nor that I am not old enough to claim social security retirement benefits – not even early social security.

However, in my spirit, I knew it was time to move on to my creative pursuits.

My time to retire had arrived. It was time to go.

I was ready to quit my job and retire.

I still remember a conversation I had with a dear friend of mine in Atlanta.

I was explaining that if I worked even 5 more years, how much more money I could stack. I was second-guessing myself.

Did I really want to quit my job and retire early?

In the same breath, I also mentioned how I had days that I absolutely dreaded going to work and would rather be at home working on my own God-given talents.

She merely responded to me saying “Sherry, how much is enough? When are you going to step out on faith and do what you were born to do?”

Yes! Sometimes we need a good friend to keep it real for us and throw pearls of wisdom our way.

Trading Time for Money

I did not want to work until the traditional retirement age of 62 or 65.

I was tired and fed up with trading my time for money.

I was now all in to quit my job and retire early.

In lieu of a retirement party, I celebrated with a huge birthday weekend with family and friends flying in from all over to join me in Los Angeles.

There was a game night at my house, an Oldies Birthday Bash on Saturday, and then we closed it all out with a Celebratory Birthday Brunch on that Sunday.

I love the Crest commercial where the young lady announces she’s leaving her company with an ‘I Quit’ cake commercial.

I was so tempted to bring my own ‘I Quit’ cake.

However, in the end, I decided to take a more subtle approach to tender my resignation.

I put it in writing and officially announced my resignation to our team at our monthly project update meeting.

I will truthfully say that I did not retire with a million-dollar portfolio (tho’ I’m still working on that).

Still, I wasn’t willing to put in 5 to 15 more years to achieve that in my last place of employment.

Early retirement and financial freedom mean different things to different people.

For me, I wanted to be able to retire while I’m healthy enough to enjoy traveling.

I was ready to have more time to wholeheartedly work on my creative pursuits, and have the bulk of my bills paid off.

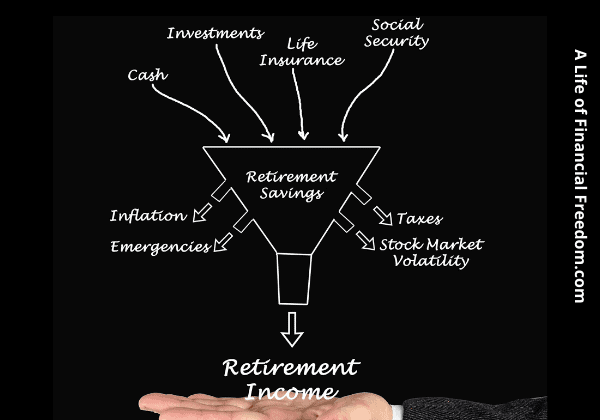

Below are the Simple Retirement Strategies that worked for me.

Maybe some of these will work for you, or at the very least, inspire you to retire earlier than anticipated if that’s what you desire.

Make a Plan

Write out your plan for retiring. Choose your actual retirement date, down to the day and year.

How will you receive income during retirement? Passive income pursuits? Rental property? A pension? Savings?

Set Financial Goals and Review Them Often

Determine what sacrifices you’re willing to make to reach your retirement goal.

Small sacrifices worked for me, such as packing and taking my lunch to work instead of eating out daily.

I started my government job with the idea of it being the last “Job” that I wanted to work.

I worked on aggressively paying off my bills and paying on my student loans.

I still have a mortgage and those dreaded student loans though.

Worked on Increasing My Multiple Streams of Income Before Quitting

I am the self-proclaimed Queen of Side Hustles.

My Side Hustle earnings over the years were one of the greatest factors towards my being able to retire earlier than anticipated.

I used those earnings to whittle away at other outstanding bills and saved some for investing and as an emergency fund buffer.

I have been working as an Airbnb host/ house hacking (renting out a room in my home) for years now.

Here’s a referral link if you’re curious or interested in getting started.

Airbnb is still one of my most lucrative and fun ways to bring in extra monies.

Listed below are some of my other Side Hustle income ventures:

- An Amazon t-shirt business (Merch by Amazon)

- A children’s book series: My Mystical, Magical, Shrinking Hair

- Author workshop

- Creating an info product

- Launching an Online Course on Teachable

- Selling items on eBay

- Focus Group Participant

- Getting Paid to Watch TV

Paid for Certain Things Before Leaving the Job

I paid for some things that I really wanted to do BEFORE I left my 9 to 5.

I’ve always wanted to attend the Adobe Max conference and it was held in Los Angeles, so that went on my Paid For Wish List.

It helped that I lived in the conference city, so I didn’t have to worry about getting a hotel.

I also made sure I paid for and attended my first FinCon (Financial Conference) in Washington DC before retiring.

Both of those conferences were so insightful, chockful of information, networking, and worth every penny that I spent.

Emergency Fund

I made sure that I had an Emergency Fund to cover from 1 to 2 years of expenses – just in case.

Health Insurance

One of the biggest blessings in my retiring, when I did, is that I will have insurance coverage for the rest of my life.

Side Hustle Ideas for You

If you’re interested in bringing in some extra money (and who isn’t), consider some of the side hustle gigs below.

A good rule of thumb is to start out by finding/creating a Side Hustle around your passion.

Look at Side Hustle ideas in the list below to get you started:

- Start a blog

- Buy and Sell domain names

- Become a business coach

- Podcaster

- Vlogger

- Affiliate Income

- Brand Ambassador

- Freelancer

- Write and sell eBooks on Amazon

- Housesit

- Teach English

- Rent out a room in your home

Retirement Desires

I am extremely excited about all of the personal projects that I’ve always wanted to pursue outside of a 9 to 5.

Now I have time to check some of those off my list.

Since I’ve been working really diligently on this website, time isn’t as plentiful as one would imagine, at least for me, anyway.

My lesson to myself is to remember that building this website and my brand won’t happen overnight and that it may take a couple of years for it to get traction and grow.

Still, I’m working to create a healthy balance of project work and passion work in my retirement.

It’s fun just to think about some of the things I want to do – and to start checking them off my list.

Have you ever just sat and made a list of things you would like to do during retirement? Here’s some of mine:

- Take piano classes

- Guitar classes

- Spend some time in Cuba or Spain to learn Spanish

- More time to leisurely read books

- Explore events in my neighborhood

- Photography classes

- Take a bath in the middle of the day

- Borrow my friends pooch for the day and treat him to time at the park

- Take in a movie in the middle of the day during the week

- Learn to make beautiful hand soaps

- Create a networking/social mixer

As much as I love to travel, you’ll notice that I only have Cuba and Spain on my list.

In the process of retiring, I decided to spend more time at home for a while to explore events and activities in and around Los Angeles.

Post Retirement

Although I am only recently retired, I must admit that I absolutely love being retired.

There is nothing like watching the early morning news and seeing that traffic is terrible, but knowing that I don’t have to get out in it.

A major plan is to continue to network by joining FaceBook groups and Instagram.

People need to know that I exist and in today’s world, a lot of that is done online.

That also means I have to consider building a more digital presence, perhaps in the way of video via Facebook Lives, Instagram, a YouTube channel, or a Podcast.

In the process of all of this building and networking, I have to remind myself to slow down and enjoy the process of retirement.

Now it’s your turn to share with me.

Let me know in the comments below if you’re on track to retire or if you’ve already retired. Share your savings nuggets of wisdom.

Related Articles

10 Must Read Side Hustle Income Books

Tips for Saving Your First $1,000