10 Ways to Grow Your Money

Explore these 10 ways to grow your money.

This page contains affiliate links at no additional cost to you.

In today’s dynamic financial landscape, effectively growing your wealth requires strategic planning, informed decision-making, and disciplined execution.

With many investment avenues and financial instruments available, understanding and implementing the right strategies is paramount to achieving financial independence.

This article delves into ten actionable methods to enhance your financial portfolio, from traditional investment approaches to modern financial techniques.

By exploring these strategies, you’ll be equipped with the knowledge to make informed choices that align with your financial goals and risk tolerance.

Embarking on this journey necessitates a commitment to continuous learning and adaptability.

As market conditions evolve, so should your strategies, ensuring your wealth grows and is safeguarded against potential downturns.

Let’s explore these ten strategies to empower your financial growth and set the foundation for a secure financial future.

(1). Minimize Debt and Interest Payments

There’s nothing like debt hanging over your head and weighing you down. High-interest debt, such as credit card balances, can erode wealth.

Paying off debt quickly and avoiding unnecessary loans frees up money for savings and investments.

Being overloaded with debt is a dreadful, awful feeling and situation to be in.

You may consider consolidating debt into one payment with a lower interest rate.

Another method uses the snowball effect of paying off the highest-interest debt first and then tackling the next debt, or even one of the strategies below may work for you.

Once you’re out of debt, you can see how to grow your money further.

Research ‘get out of debt tactics‘ to find additional debt reduction strategies that work best for your situation.

(2). Start a Side Business

We are in what’s now known as the ‘Gig Economy’, where specific tasks are usually contracted on a short-term basis.

Working or creating your Side Income gig or hustle can allow you to stockpile funds to grow your income or even pay off debt.

A side business can generate additional income and grow into a full-time venture.

Whether e-commerce, freelancing, or offering services, a side hustle can supplement your income and create financial independence.

Popular side hustles include Airbnb, Instacart, Uber, Lyft, and dog-walking services.

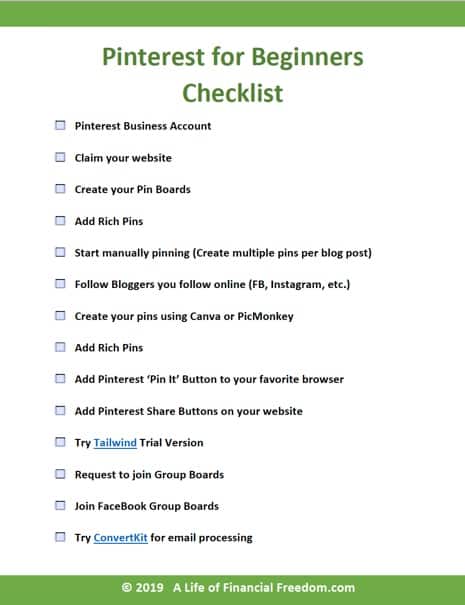

You may even have a niche idea and decide that starting and growing a blog is a side hustle you wish to pursue.

Read here how this young lady grew her blog from $0 to over $50,000 monthly.

Download this free ebook: 40 Side Hustle Income Ideas.

(3). Stop Wasting Your Money in a Regular Savings Account

A high-yield savings account offers better interest rates than traditional savings accounts. This helps your money grow with minimal risk while keeping it easily accessible.

Enjoy higher interest with online savings accounts that pay more than traditional banks.

High-yield online savings accounts usually offer higher earnings than traditional brick-and-mortar banks because they don’t have the high overhead of a branch building with multiple employees.

The convenience factor is lowered when dealing with an online bank because you can’t just run to the bank and make a transaction.

However, not having instant access to your money can be a plus when working to grow your money.

Suppose you deposit $10,000 in your traditional brick-and-mortar bank. By the end of the year, you may receive about $1 in interest back.

If you deposit the same $10,000 in an online bank, that $1 interest could be $150, depending on the current interest rate.

That’s a significant difference and an easy way to grow your money faster.

Interest fees vary, so you want to check different online banks. Also, make sure the bank is FDIC-insured.

(4). Start a Retirement Plan early.

The sooner you start planning for retirement, the more time your money has to grow. Due to compound interest, even small contributions in your 20s can grow significantly when you retire.

Starting early and consistently investing allows you to benefit from compound interest, where your earnings generate even more over time. The earlier you start, the more exponential the growth.

(5). Build up Your Emergency Fund

Don’t let the lack of an emergency fund be the culprit in stopping your money from growing.

The inevitable is bound to happen at some point in life, be it an unexpected layoff, broken water pipes, car problems, or something else.

Guard yourself as much as possible with an emergency fund to give you a financial cushion when the inevitable happens.

If starting from $0, work towards getting your Emergency Fund to $1,000.

Here are 6 tips to saving $1,000:

- Create a Budget

- Cut Expenses (see below)

- Bring in more income

- Shop new home and auto insurance rates

- Automate your savings

- Don’t grocery shop without a list

(6). Reduce Unnecessary Expenses

Reducing non-essential expenses frees up money that can be redirected into investments or savings. Budgeting and tracking spending can help identify areas to save.

Cut your expenses by price-comparing your cable, phone, and other negotiable bills.

Are there any subscription-based services you can do without to build up your savings? Kindle Unlimited, Amazon Prime, Netflix, Dropbox, or even magazine subscriptions?

Cutting expenses you can do without will allow you to grow your money by saving more.

(7). Don’t Leave Money on the Table – Maximize Your Retirement Account

You’ve probably heard the expression ‘Don’t leave money on the table’. It means not getting the most bang for your buck if you haven’t heard the expression before.

Here’s an example. Let’s say your employer offers a 401k and matches it up to 5% of what you put in.

If you only contribute 3%, you’re missing out on 2% more of free money that your employer would match. Therefore, you’re leaving ‘money on the table’.

Contributing to tax-advantaged retirement accounts like a 401(k) or an IRA allows your money to grow tax-deferred or tax-free. Employer-matched contributions further accelerate your savings.

(8). Learn tax strategies

Learning tax planning strategies can help you pay as few taxes as possible.

What better way to grow your money than by holding on to some of it?

Learning tax strategies will help you go beyond claiming the obvious tax deductions. It will increase your tax knowledge and your bottom line regarding money saved.

Ensure you claim all possible deductions and credits for which you’re eligible.

I’ve used tax strategies, including making my January mortgage payment in December, paying my March tax payment in December, and reducing my taxable income by receiving payments the following year.

I’ve also reduced my taxable income (equates to a lower tax bill) by keeping track of my Airbnb business supplies and expenses, which are business write-offs.

If you own a business, keep impeccable records throughout the year. You will thank yourself for it when tax season rolls around.

(9). Diversify Your Investments

A well-diversified portfolio reduces risk and increases the likelihood of stable growth. Investing in a mix of stocks, bonds, real estate, and alternative assets helps mitigate financial downturns.

(10). Stay Educated about Financial Trends.

Keeping up with market trends, investment opportunities, and economic changes allows you to make informed financial decisions and take advantage of emerging opportunities.

By implementing these strategies, you can grow your money and achieve financial success.

The key is to stay disciplined, continuously learn, and take action toward your financial goals.

In wrapping up our exploration of the “10 Ways to Grow Your Money,” it’s evident that effective personal finance management is a multifaceted endeavor, requiring a blend of strategic planning, disciplined execution, and continuous education.

Implementing the strategies discussed—such as budgeting, investing wisely, and planning for retirement—will lay a solid foundation for financial growth and stability.

It’s crucial to recognize that personal finance is not a one-size-fits-all journey. Individual circumstances, goals, and risk tolerances vary, necessitating a tailored approach.

Regularly reassessing your financial plan ensures it aligns with your evolving life objectives and market conditions.

Moreover, fostering a healthy relationship with money involves growing wealth and understanding and reshaping your financial behaviors.

This holistic perspective can lead to more sustainable and fulfilling financial well-being.

Remember, the journey to financial growth is ongoing. Stay informed, remain adaptable, and continue to seek knowledge.

Doing so empowers you to make informed decisions that will help you achieve your financial aspirations.

Now it’s your turn. Leave a comment below on how you use your existing money to make more money.